Why Generic Metrics Fail: The Power of Company-Specific KPIs

Most investors invest in "stocks." Smart investors invest in "businesses."

If you only look at generic metrics like P/E Ratio or EBITDA, you are treating every company the same. You are analyzing Apple (a hardware/software ecosystem) with the same ruler you use for Exxon Mobil (an oil driller).

That is a recipe for mediocrity.

To find the true "alpha" (returns that beat the market), you need to look deeper. You need Company-Specific KPIs.

The Problem with "One Size Fits All"

Imagine trying to judge a basketball player and a sumo wrestler by the same metric: "Weight."

- For the sumo wrestler, high weight is good.

- For the basketball player, high weight might be bad.

The stock market is no different.

- For a Bank: Interest rates matter.

- For a SaaS Company: Churn rates matter.

- For a Retailer: Inventory turnover matters.

If you rely on a generic screener, you miss these nuances.

What Are Company-Specific KPIs?

These are the operational numbers that drive the financial numbers. They are the cause; revenue and profit are just the effect.

Here are a few examples of what we track on Stockie that you won't find on a standard banking app:

1. Apple: "Services Revenue vs. Hardware Revenue"

Everyone knows Apple sells iPhones. But the real growth story is their Services (App Store, iCloud, Apple TV). We track the percentage of revenue coming from Services because that money has higher profit margins than selling phones.

2. Netflix: "Average Revenue Per Membership (ARM)"

Subscriber count is important, but how much is each subscriber paying? As Netflix cracks down on password sharing and adds ad-tiers, this specific number tells you if their strategy is working long before the quarterly profit report comes out.

3. Tesla: "Vehicle Deliveries vs. Production"

Is Tesla making more cars than it can sell? Or can it not make them fast enough? By tracking the gap between Production and Deliveries, you can spot inventory issues weeks before the stock price drops.

Why Stockie is Different

Most financial websites are wrappers around the same generic data feed. They all show you the same P/E ratio, the same market cap, and the same dividend yield.

Stockie.io is different.

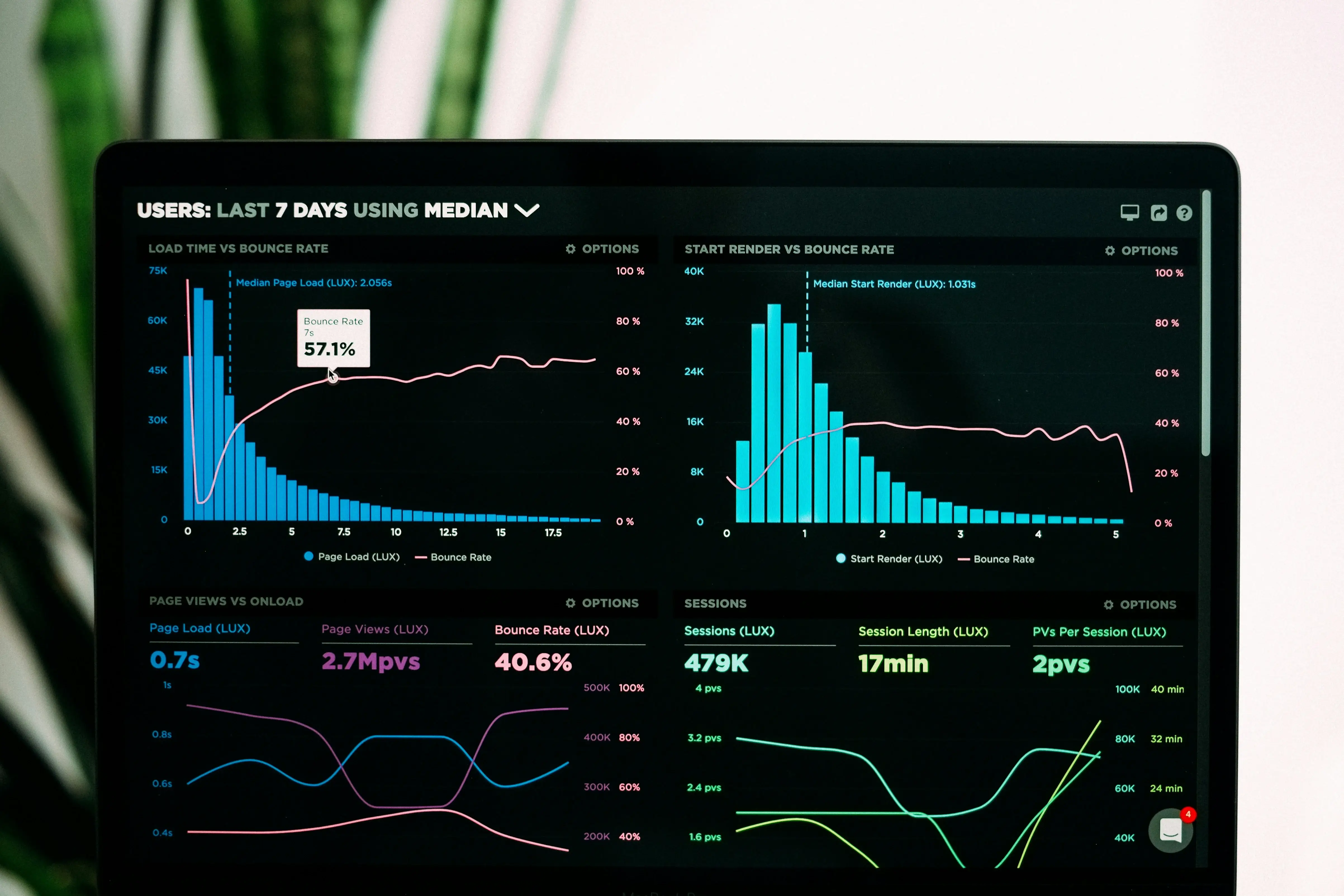

We build custom, backend-loaded interactive graphs for these specific KPIs. We don't just scrape Yahoo Finance; we visualize the operational heartbeat of the company.

- We don't just tell you Spotify's revenue; we show you their Monthly Active Users (MAUs) trend.

- We don't just tell you Costco's profit; we show you their Membership Renewal Rates.

The Edge is in the Details

Wall Street analysts have access to this data. They spend thousands of dollars a month on Bloomberg terminals to see it.

We believe retail investors deserve the same edge. When you understand the driver of the business, you stop gambling on lines on a chart and start investing in the company's future.

Check out the "KPIs" tab on any company page to see what really makes that business tick.